By James Yeretsian

Edited by Tashyana Davidson and Ifrah Ikram

In the 2022 Fall Economic Statement, the Liberal government announced a 2% tax on stock buybacks (or share repurchases) over $1 million conducted by publicly traded Canadian-resident corporations. The tax came into effect on January 1st, 2024, and follows the U.S. tax of 1% on stock buybacks in 2023. The goal of both jurisdictions in taxing stock buybacks is to encourage corporations to re-invest corporate profits in areas that will increase productivity and innovation, such as workers and research and development (R&D).

A stock buyback is when a publicly traded company repurchases its own shares from the stock market at market prices. Corporations use stock buybacks as a way of returning money to shareholders. In recent years an astronomical amount has been spent on buybacks. Corporations also provide returns to shareholders by issuing dividends and/or re-investing profits in productive units (hiring more employees, increasing wages, expanding production, investing in R&D), which increases share value in the long-term as the company improves.

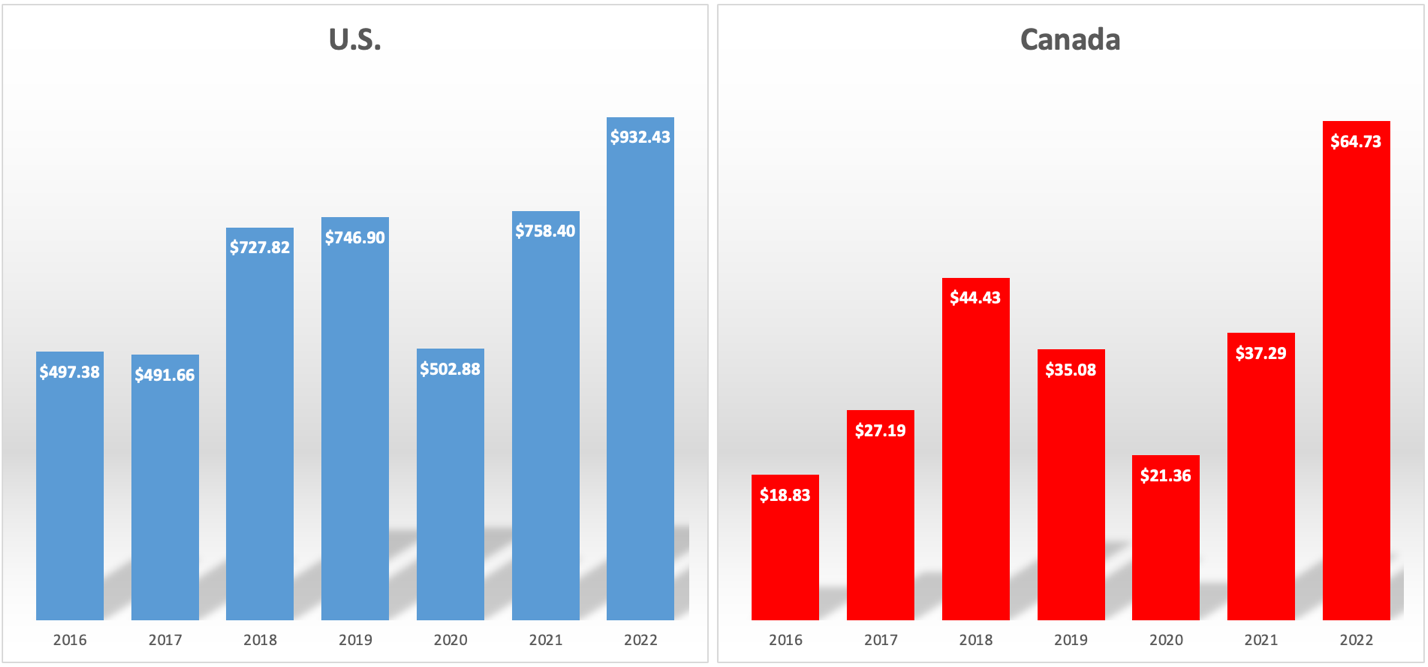

While U.S. based companies spend by far the most on buybacks globally, Canadian firms have dramatically increased their usage of buybacks in recent years. In 2022 alone, Canadian companies spent almost $70 billion on repurchases. Canadian companies such as Loblaw, Suncor, TD, RBC, and Thomson-Reuters Corp, have poured billions into buybacks, frequently spending upwards of a billion in a single year to conduct buybacks.

Figure 1. Amount Spent on Buybacks in the U.S. and Canada, 2016-2022 (in USD billions)

Source of Data: Janus Henderson Investors

Of the 37 companies that directly received the Canada Emergency Wage Subsidy (CEWS) during the pandemic, 32 of them conducted stock buybacks. The CEWS was a multibillion-dollar publicly funded program with the intent of keeping many employed. However, it was clearly not desperately needed by the 32 companies that spent a combined $41.1 billion on buybacks through the heart of the pandemic in 2020 and 2021. Twelve of these companies did their largest share buyback ever during 2021.

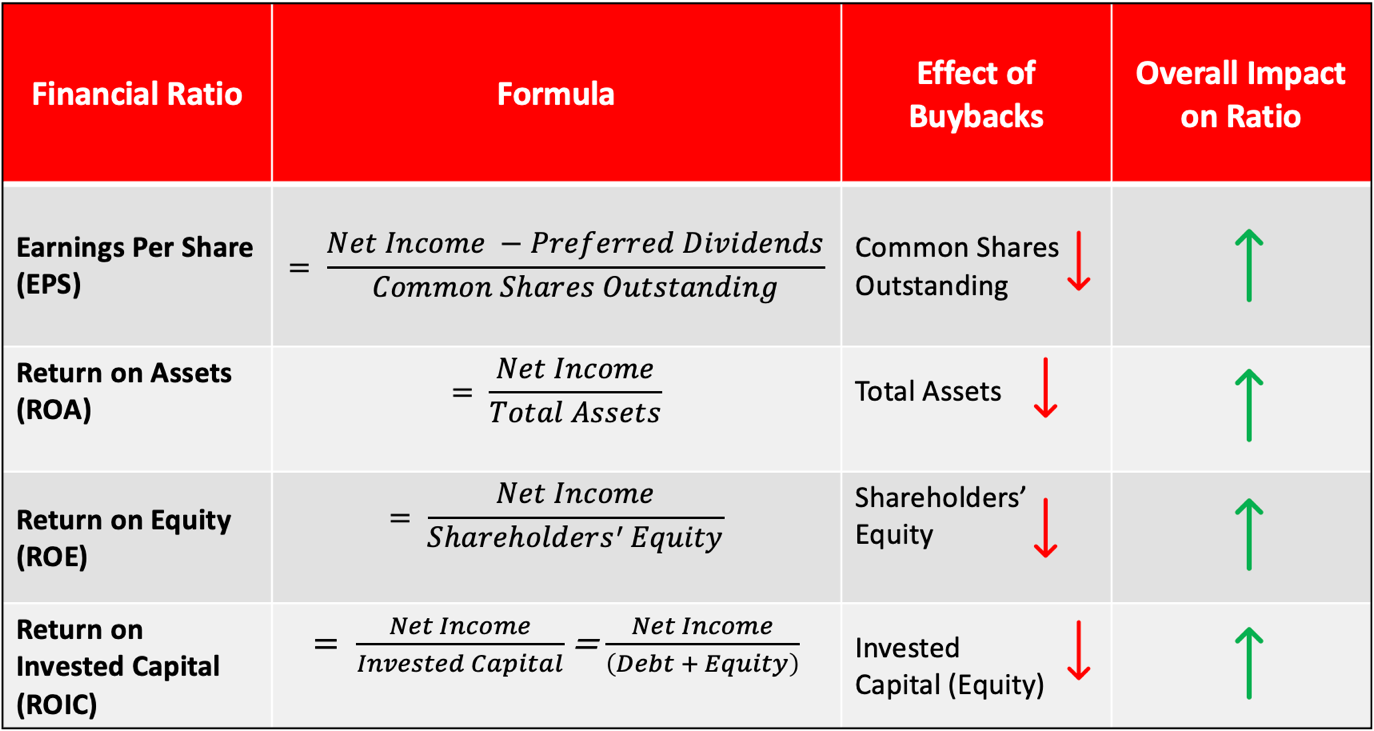

Why have buybacks been so popular among corporations? Because it is a quick way to boost share prices. When a company repurchases its own shares, it reduces the number of shares outstanding. The reduction in outstanding shares increases the value of all remaining shares and makes many financial ratios more attractive. These are also the same financial ratios that are often used as performance benchmarks for executive bonuses.

Figure 2. Effect of buybacks on financial ratios

Source of Formulas: Investopedia

Critics of buybacks say the practice does nothing to improve or expand a company’s underlying business, which should be the driving factor of stock price appreciation. Many have called the practice “paper manipulation” and “effectively stock-price manipulation.”

As such, the federal government should be incentivizing companies to re-invest profits in activities that will generate long-term growth. Without a buyback tax, companies see much more flexibility and value for shareholders to conduct a buyback since dividend income is taxed at a higher rate than capital gains tax. Now that the tax is in place, corporations must consider the trade-offs between conducting buybacks, issuing dividends, re-investing profits, and retiring debt.

Proponents of Canada’s 2% buyback tax believe it will encourage corporations to reinvest in their workers and businesses, which is needed for a country frequently said to have productivity growth and investment issues. Canadian energy companies were the most active repurchasers of any sector in 2022, and Environment Minister Steven Guilbeault has accused oil companies of this while they have made limited investments in the energy transition. While the tax does not single out Canada’s oil and gas giants, it is certainly consistent with Budget 2023’s other tax measures that encourage investment into the energy transition, such as tax credits for clean hydrogen, clean technology manufacturing, and carbon capture, utilization, and storage.

Those in favour of buybacks see it as a legitimate way of returning money to shareholders in a more tax-efficient manner than dividends. They also say buybacks allow companies to signal to the market that their intrinsic value is higher than what the market is indicating. They argue that there is no place for governments to impede how a company allocates its capital structure.

Among corporations in Canada, the tax has not been popular. Corporations say the tax will limit the efficient allocation of investor capital and that it may have the unintended consequence of discouraging investment into Canadian-run businesses. Others note that the tax may not change firm behaviour in the way it is intended to. Due to the high interest rates, firms that have outstanding debt may be more motivated to retire such debt instead of re-investing profits. But firms with strong balance sheets may now avoid repurchases and choose to issue dividends or re-invest.

Overall, taxing buybacks will make buyback-obsessed corporations evaluate the trade-offs of conducting a buyback. Even if the tax does not change corporate behaviour, the federal government will gain a new source of revenue to spend on social programs in need of additional funding as the tax is expected to raise $2.5 billion over five years.